We use cookies to improve your experience on our website. By continuing, you acknowledge that cookies are being used. To find out how to manage or opt out of cookies visit the cookie notice.

Getting insurance in super with us

There are a few ways you can get insurance cover with us—automatically or by applying for cover.

Automatic insurance

If you’re a member with us, it’s likely you’re eligible for automatic insurance cover.

It’s important to know that when you have insurance cover with us—you can make changes to your cover at any time.

Am I eligible?

To find out if you’re eligible for insurance cover, review the products listed below to see what we offer and the insurance that’s available.

MLC MasterKey Business Super

If you’re an MLC MasterKey Business Super member, we’ll automatically provide you with insurance cover if you meet the eligibility requirements.

Find out which insurance types have automatic cover

-

What is it? This pays a lump sum if you die or are diagnosed with a Terminal Illness Is automatic insurance included? Yes—MLC Lifestage or Employer selected (If you meet the Eligibility requirements) Cover can start from age 15 to 69 Cover ends at age Lifestage cover: 70

Employer selected: 65 or 70

Are pre-existing medical conditions covered? Yes, provided when cover starts you were:

- actively performing, or

- capable of actively performing,

all of the duties of your usual occupation with your employer (for at least 30 hours per week) free from any limitation due to illness or injury.

Does work status at date of injury or illness affect cover? No Is cover provided if a claim has previously been paid under the same type of cover? No Is there a waiting period before a claim can be made? No

-

What is it? Pays a lump sum if you’re unable to work ever again due to illness or injury. Is automatic insurance included? Yes — Lifestage and Employer selected

Cover can start from age 15 to 69 Cover ends at age Lifestage cover: 65

Employer selected: 65 or 70

Are pre-existing medical conditions covered? Yes, provided when cover starts you were:

- actively performing, or

- capable of actively performing,

all of the duties of your usual occupation with your employer (for at least 30 hours per week) free from any limitation due to illness or injury.

Is cover provided if a claim has previously been paid under the same type of cover? No Is there a waiting period before a claim can be made? No

-

What is it? Provides a replacement income, if you’re unable to work. Is automatic insurance included? Yes — Lifestage and Employer selected

Cover can start from age 15 to 65 Cover ends at age Lifestage cover: age 65

Employer selected: Up to age 65

Are pre-existing medical conditions covered? Yes, provided when cover starts you were:

- actively performing, or

- capable of actively performing,

all of the duties of your usual occupation with your employer (for at least 30 hours per week) free from any limitation due to illness or injury.

Does work status at date of injury or illness affect cover? Yes—you must be working to claim IP benefits

Is cover provided if a claim has previously been paid under the same type of cover? Yes Is there a waiting period before a claim can be made? Yes

Making sure you’re eligible

You must be a member of MLC MasterKey Business Super.

You must be an Australian Resident, to receive automatic insurance cover.

You must be aged between the relevant ages as specified in the Insurance Guide which is part of the Product Disclosure Statement.

Keep in mind the Product Disclosure Statement (PDS) you received when you joined our super fund is the most relevant document for your membership, along with any important communications we send you about changes.

In some cases, you may not be eligible to have insurance cover, see the Insurance Guide which is part of the Product Disclosure Statement for more details about eligibility criteria.

It’s important to check your occupational rating in your Welcome Kit and Annual Statement. Find out more about occupational rating classifications.

Limited Cover

You may have some limitations on your cover when your insurance starts if you don’t meet all the eligibility requirements to get full cover.

Limited Cover means you’re only able to claim for an illness that first becomes apparent or an injury which first occurs on or after the date your cover starts.

You’ll receive Limited Cover if one of the following applies to you:

Your cover starts within 180 days of your Member Commencement Date, and you’re not At Work on the date that your cover starts. Member Commencement Date is the later of:

|

Limited Cover applies until you have been At Work for 60 consecutive days. At Work means you were actively performing, or capable of actively performing all of the duties of your usual occupation with your employer (for at least 30 hours per week) free from any limitation due to Illness or Injury. |

| Your cover starts more than 180 days from your Member Commencement Date. | Limited Cover applies until you have been employed continuously for 24 months from the date your cover starts.

|

Limited Cover doesn’t apply to voluntary insurance.

Keep in mind the Insurance Guide which is part of the PDS you received when you joined our super fund is the most relevant document for your membership, along with any important communications we send you about changes.

Please see this Insurance Guide to learn more about limitations of cover which may apply to you by logging in at mlc.com.au

Automatic cover

Your employer selects the insurance cover for your plan. This can include Death, Death and Total and Permanent (TPD) insurance and Income Protection insurance cover.

You can see what insurance cover you have in your Welcome Kit, or your Insurance Summary if your insurance cover starts after you join us.

Remember to be eligible for automatic insurance cover to start, you’ll need to be at least age 25 and have a super balance that has reached $6,000, or tell us in writing that you want cover — unless your employer pays for the cost of your cover, or a dangerous occupation exception applies.

Changing your cover

- To increase your cover, you can complete a Change Cover online application.

- To cancel or decrease your insurance cover, complete the Reduce or cancel your insurance cover form or call us.

If you have a life event, you may be eligible to apply to increase your insurance without medical information. To find out more refer to the Apply to increase your insurance without medical evidence section below.

Applying for Voluntary cover

If you’d like to apply for voluntary MLC MasterKey Business Super insurance cover, see your Insurance Guide which is part of the Product Disclosure Statement for availability and eligibility requirements. Depending on your circumstances, you’ll need to complete either a short or long insurance application form available by logging in to mlc.com.au or at the Forms & Documents page.

The insurance application – short form (PDF) is called the MLC MasterKey short form personal statement and the insurance application – long form (PDF) is called the MLC MasterKey Request for insurance/personal statement.

These forms will ask you questions such as your age, job, medical history, family history and lifestyle. As part of your application, you’ll need to let us know if you take part in any high-risk sports or hobbies. When you apply for any insurance cover, you should take reasonable care not to make any misrepresentations. Any failure to do so may significantly impact your ability to claim on any cover granted.

Manage your insurance

Visit Forms & Documents for a full list of insurance forms. We’re here to help. Chat with us or call on 132 652

MLC MasterKey Personal Super

If you are an MLC MasterKey Business Super member and your employer has told us that you’re no longer their employee —you’ll be transferred to MLC MasterKey Personal Super.

We’ll also transfer the Death and Total and Permanent Disablement cover you held in your employer plan account to your MLC MasterKey Personal Super account (subject to eligibility requirements).

If you held Income Protection insurance cover in your employer plan, it will be cancelled but if you’d like to keep it, you’ll need to reinstate it—find out more.

Making sure you’re eligible

You must have been a member of MLC MasterKey Business Super.

You must be aged between the relevant ages—as specified in the relevant Insurance Guide which is part of the Product Disclosure Statement.

Any other eligibility requirements included in the relevant Insurance Guide which is part of the Product Disclosure Statement.

Keep in mind the Insurance Guide which is part of the PDS you received when you joined our super fund is the most relevant document for your membership, along with any important communications we send you about changes.

It’s important to check your occupational rating in your Insurance Summary, Welcome Kit and Annual Statement. Find out more about occupational rating classifications.

Applying for Voluntary cover

If you don’t have insurance cover when your account is transferred to MLC MasterKey Personal Super, you can apply for voluntary cover by logging in to your account online, or by completing the short or long Insurance application depending on your circumstances.

The insurance application – short form (PDF) is called the MLC MasterKey short form personal statement and the insurance application – long form (PDF) is called the MLC MasterKey Request for insurance/personal statement.

These forms will ask you questions such as your age, job, medical history, family history and lifestyle. As part of your application, you’ll need to let us know if you take part in any high-risk sports or hobbies. When you apply for any insurance cover, you should take reasonable care not to make any misrepresentations. Any failure to do so may significantly impact your ability to claim on any cover granted.

Changing your cover

- To increase your cover, you can complete a Change Cover online application by logging in to your member account or call us.

- To cancel or decrease your insurance cover, complete the Reduce or cancel your insurance cover form by logging in to your member account or call us.

If you have a life event, you may be eligible to apply to increase your insurance cover without medical information. To find out more about this refer to the Apply to increase your insurance cover without medical evidence section below.

Find out more about what happens to your insurance when you leave your employer.

MLC MasterKey Super Fundamentals

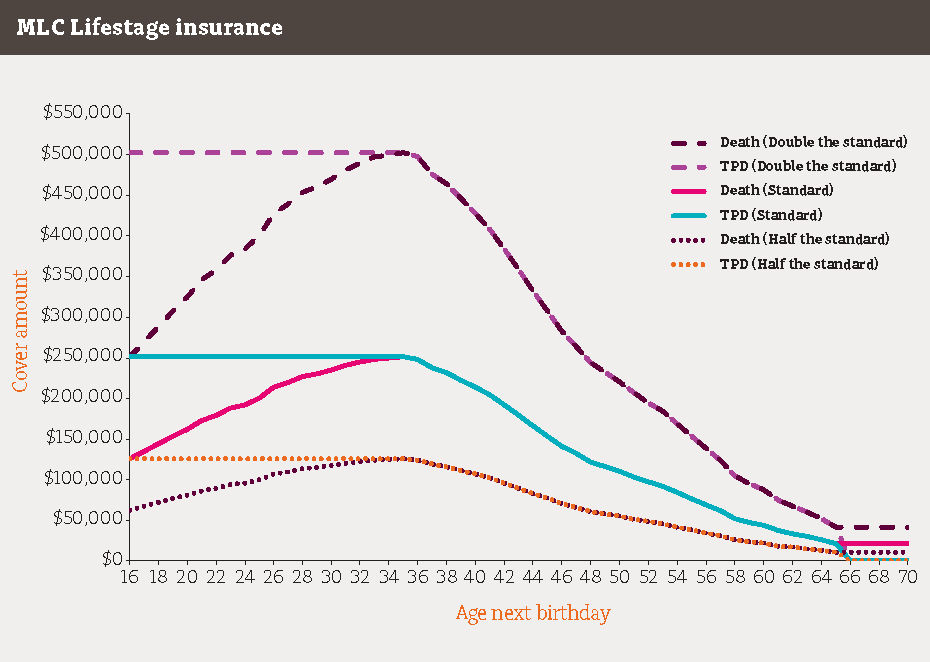

MLC MasterKey Super Fundamentals comes with an option called MLC Lifestage insurance, so you can enjoy quality insurance benefits.

What’s MLC Lifestage insurance?

Having MLC Lifestage insurance means that you can have a combination of Death and Total and Permanent Disablement (TPD) insurance that’s designed to protect you and your loved ones through your different life stages.

You may need more insurance when you’re younger, when you’re most likely to have a high mortgage or children at home, and lower insurance when you’re older and most likely to be financially secure.

Making sure you’re eligible

You must be an Australian Resident on the day your account starts, and have money in your account within 130 days.

For Death insurance (including Terminal Illness), you must be between ages 15 and 69 and for TPD insurance you must be between ages 15 and 64.

If you’re employed in an occupation that the Insurer classifies as ‘uninsurable’, you won’t be eligible for insurance. The Insurer classifies some jobs as ‘uninsurable’ because the Insurer is unable to accept the risk. To find out if this applies to you, see the Occupational rating guide for insurance.

To find out more about the insurance options available in your MLC MasterKey Super Fundamentals, see the Insurance Guide or contact your financial adviser.

Don't have insurance?

You can apply for MLC Lifestage Insurance or a nominated amount by completing the Insurance application form.

The Insurance application form will ask you questions such as your age, job, medical history, family history and lifestyle. As part of your application you’ll need to let us know if you take part in any high-risk sports or hobbies. It’s important that you disclose any information that could impact the decision to insure you.

Changing your cover

- To increase your cover, complete the Insurance application form.

- To cancel or decrease your cover, complete the Reduce or cancel your insurance cover form or call us.

If you have a life event, you may be eligible to apply to increase your insurance without medical information. To find out more about this refer to the Apply to increase your insurance without medical evidence section below.

Don’t have an account with us?

Create a new account with us in as little as five minutes. MLC super supports you through every stage of your working life.

Apply to increase your insurance without medical evidence

Life can dramatically change when you get married, buy your first home, or have a child. These events might mean that your insurance needs may change too.

We know how important it is to make sure you and your family are protected. That’s why when big things like these happen, we make it easy for you to increase your Death and Total Permanent Disability (TPD) insurance.

From ages 15 to 64 you can apply to increase your Death and TPD insurance without further medical evidence, when you:

- adopt or have a child

- become a carer for the first time

- suffer the death of a spouse

- get married or divorced

- complete your first undergraduate degree at an Australian Government-recognised institution

- have a child who starts secondary school for the first time, or

- take out a mortgage for your first ever purchase of a principal place of residence or an increased loan to renovate your principal place of residence.

If you’d like to increase your insurance cover because any of these life events have happened to you within 90 days, complete the Apply to increase your insurance without medical evidence form.

Considerations

Cost of premiums

Before taking out insurance, you should consider the cost of premiums and impact to your retirement savings.

Get the cover that’s right for you

Use our insurance estimator to find out the cover that’s right for your lifestyle. You can find out what type and level of insurance cover you may need, and the cost.

Consolidate your insurance

It’s easy – just complete a Consolidate your insurance form and send it back to us today.

Call us

Talk to us on 132 652 between 8am to 6pm AEST, Monday to Friday

Request a call back

Complete our contact form

Financial Advice

Find out how you can plan for your future

NULIS Nominees (Australia) Limited ABN 80 008 515 633 AFSL 236465 is part of the Insignia Financial Group of Companies, comprising Insignia Financial Ltd ABN 49 100 103 722 and its related bodies corporate (Insignia Financial Group).