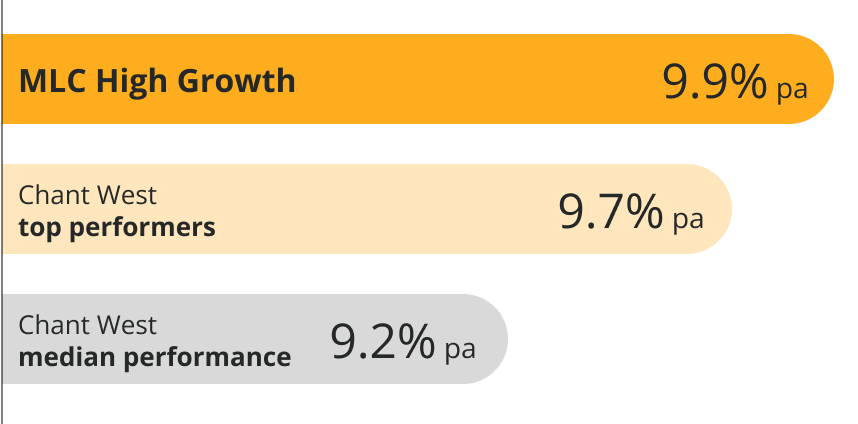

1 Chant West Super Performance Survey MLC High Growth (81-95%) net returns to 30 September 2025. Returns are expressed net of investment fees and tax. Performance returns are annualised for periods greater than one year (p.a. = per annum). The future value of an investment in an investment option will rise or fall with market changes. Past performance is not a reliable indicator of future performance. MLC High Growth option provides a diversified portfolio that's invested in more traditionally-focused growth assets that tend to provide higher levels of long-term capital growth but may also carry the highest risk in the short term. Find more information.

2 The Financial Coaches provide financial advice under the Australian Financial Services Licence (AFSL) of Actuate Alliance Services Pty Ltd ABN 40 083 233 925 AFSL 240 959 (Actuate). NULIS has appointed Actuate to provide general and limited advice services (which includes Simple super advice) to members of relevant products in the MLC Super Fund. Actuate is also part of the Insignia Financial Group.

Any advice or information provided to you by a Financial Coach during a super consultation will be of a general nature only and will not take into account your personal objectives, financial situation and needs. Because of that, before acting on any advice provide to you, you should consider its appropriateness to you, having regard to your personal objectives, financial situation and needs. Neither NULIS, nor any other entity within Insignia Financial Group, including any other entity within the Insignia Financial Group that is a trustee for a regulated superannuation fund, is liable for or responsible for any work, action or advice provided by Actuate.

3 KPMG Super Insights Report 2025, May 2025. Based on total retirement assets within superannuation funds managed by trustees within the Insignia Financial Group, including the MLC Super Fund.

4 Chant West Pension Fee Survey, September 2025. Based on administration fees and costs for MLC MasterKey Pension Fundamentals (including a $ based Member Fee, a % based Plan Management Fee, Trustee Levy, and Other administration fees and costs paid from reserves) on a $250k balance (which is roughly the average pension account balance in non-SMSF funds) for pension products in the Growth Index (61–80% growth assets) which covers 62 pension products including 19 industry fund products.

5 Over a 12-month period to June 2025. Assumes a Pension Bonus rate of 1.25%, which is accurate as of 1 July 2025 (subject to change).

The Canstar 2025 Outstanding Value Account Based Pension award was received in September 2025 for MLC MasterKey Penson Fundamentals.