Learn more about MLC MySuper

How has the MLC MySuper options performed?

Investment returns to 31 January 20261

MLC MySuper2 |

Returns (%) | Annualised Returns (% p.a.) | ||||

| 1 month | 3 months | 1 year | 3 years | 5 years | 10 years | |

| MySuper Growth Portfolio | 0.7% | 1.1% | 8.0% | 9.5% | 8.3% | 7.9% |

| MySuper Conservative Balanced Portfolio | 0.6% | 1.0% | 7.1% | 7.6% | 6.0% | NA3 |

| MySuper Cash Portfolio | 0.3% | 0.8% | 3.4% | 3.7% | 2.3% | NA3 |

Past performance is not a reliable indicator of future performance. The value of an investment may rise or fall with the changes in the market.

1All returns are net of investment fees and tax considerations and do not include administration fees and costs. Performance returns are annualised for periods greater than one year. For details of relevant fees and costs, refer to the PDS and Investment Menu.

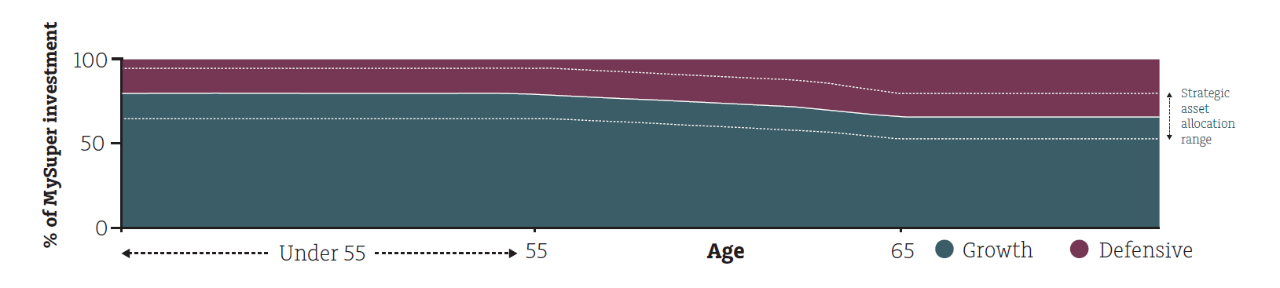

2MLC MySuper uses a combination of the three investment portfolios (MySuper Growth, MySuper Conservative Balanced, MySuper Cash), to provide a mix of growth and defensive assets which changes depending on your age. When you’re under age 55 you’ll be 100% invested in MySuper Growth. From age 55, we add a second portfolio, MySuper Conservative Balanced, where a portion of your MySuper balance will be invested. Shortly after you turn 62, you’ll be invested across three portfolios, with a portion of your MySuper balance invested in MySuper Cash.

The MLC MySuper investment strategy changed from a single diversified to a lifecycle strategy on 22 March 2019. The returns for the MySuper Growth portfolio for the period before 2019 are based on the previous single diversified investment strategy. The return for 2019 is based on the return achieved from 1 July 2018 to 22 March 2019 with the single diversified strategy, and the return achieved from 23 March 2019 to 30 June 2019 with the lifecycle investment strategy. The return for 5-years or more is based on return of the MySuper product over that period which had different investment strategies.

3The MySuper Conservative Balanced and MySuper Cash are new portfolios that were formed when the MLC MySuper product investment strategy changed to a lifecycle strategy on 22 March 2019.

![]()

MLC MySuper passed the

performance test

For the 2025 Annual Performance Test, MLC MySuper passed, together with all Trustee Directed Products within MasterKey.

![]()

MLC MySuper investment

performance

Hear from MLC's investment experts, the people managing your investment options and helping to deliver these MLC MySuper returns.

For information on our investment options, please refer to the PDS and investment menu.