2024 MLC Financial Freedom Report

- Title

- 2024 MLC Financial Freedom Report – Financial Wellbeing in Australia

- Short description

-

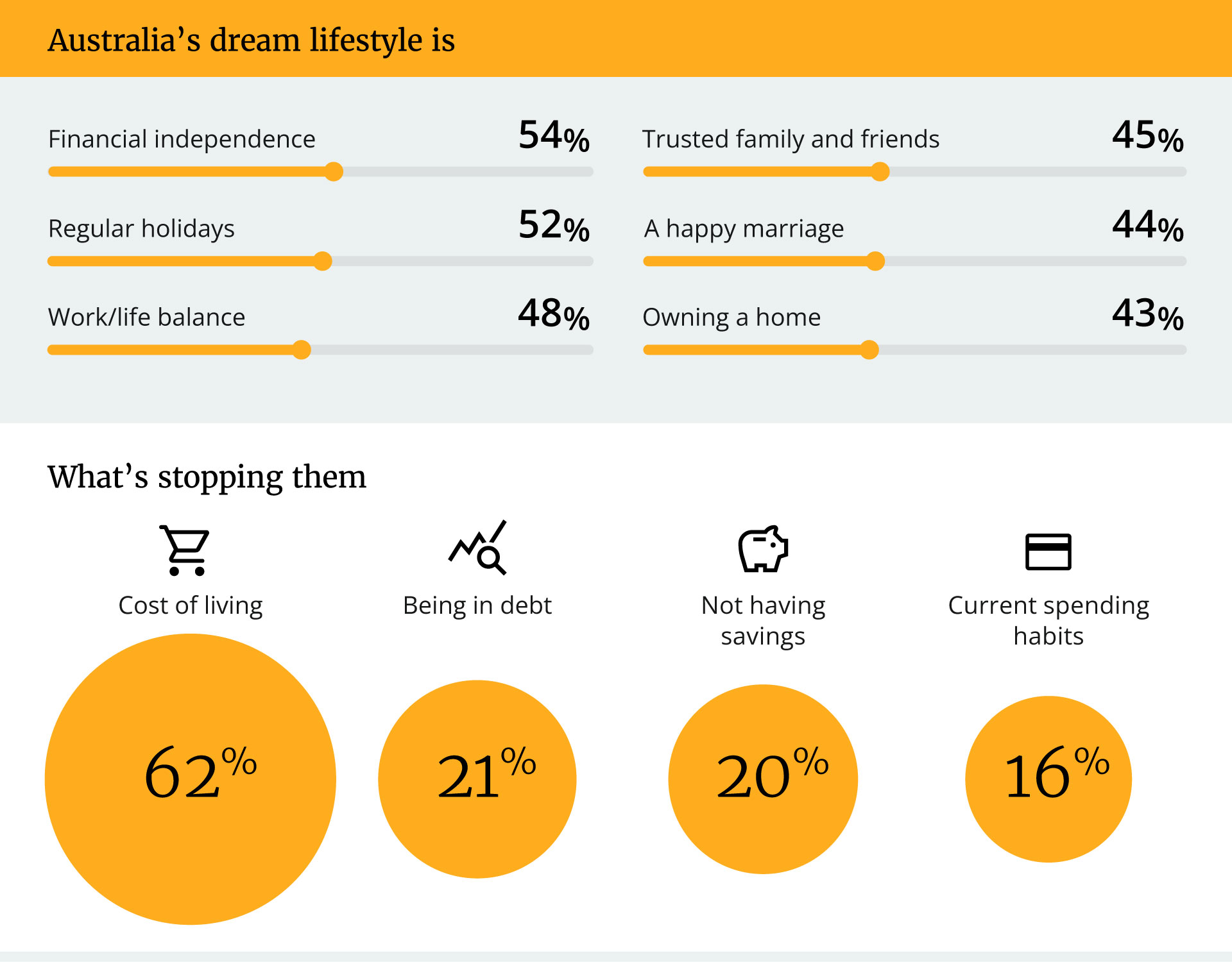

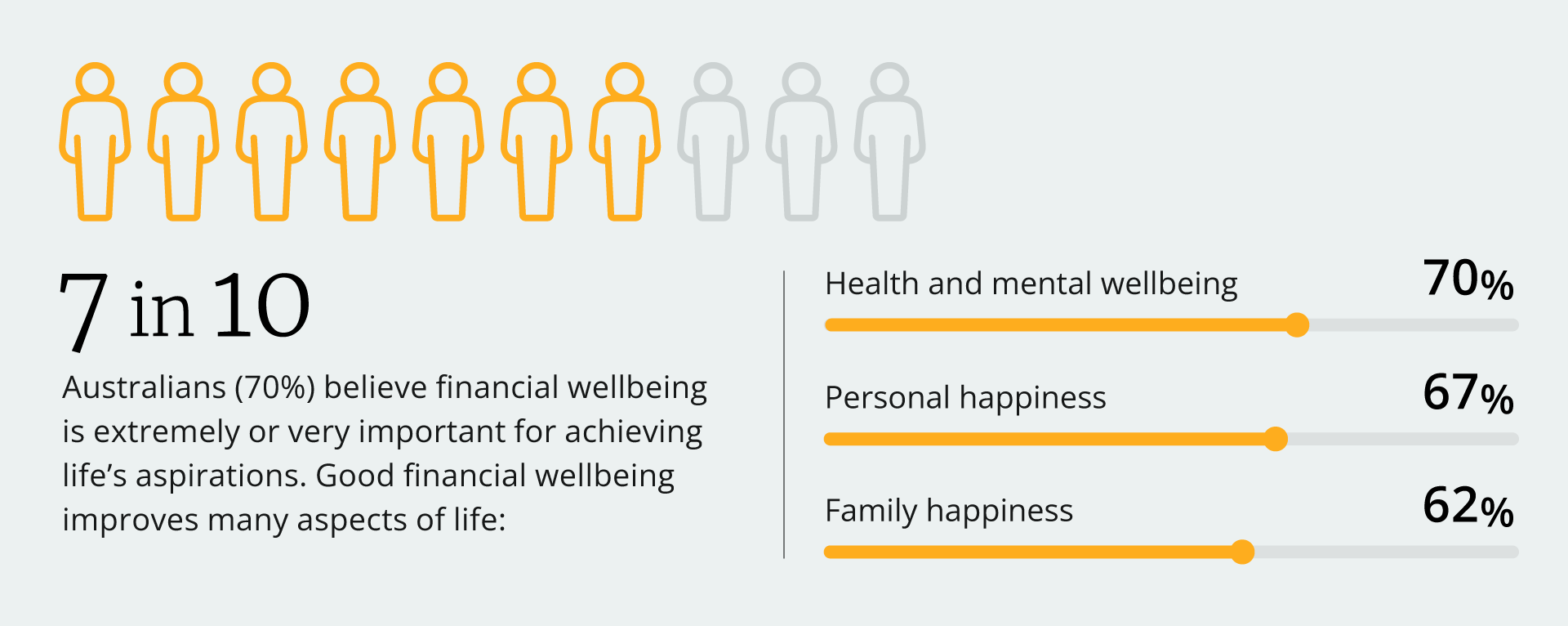

The 2024 MLC Financial Freedom Report builds on our 2022/2023 research findings. It provides an updated view of how Australians are feeling about their finances. And shows different behaviours emerging from the current social and economic challenges.

- Topics

- mlc:Topics/news-and-updates

- Time to read/watch

- 5 min

- Effective date

- 2024-10-02 00:00

- Feature Image

- /content/dam/mlc/insights/images/Articles/2024/2024-mlc-financial-freedom-report/mlc-financial-freedom-report-2024.png

- Media

- false