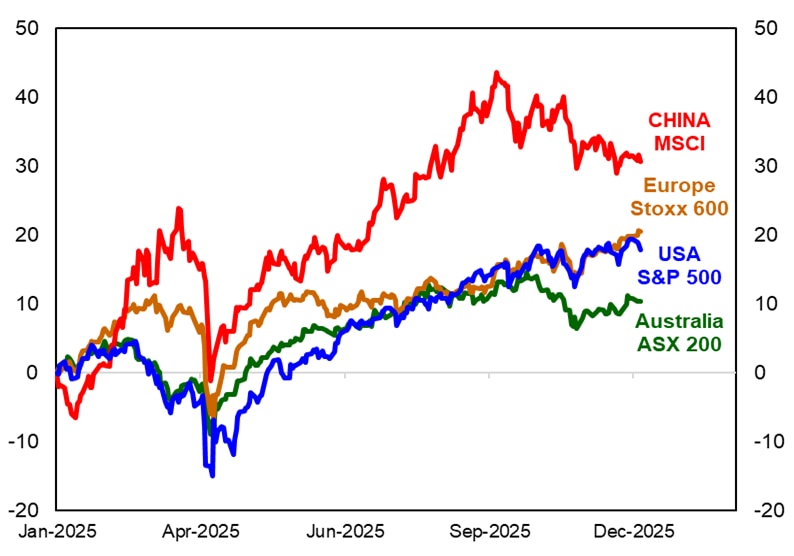

By contrast, Australia’s key technology companies were ‘could have beens’ in 2025. Wisetech recorded a painful -43% price fall while Xero declined by -32%. This is a key factor behind Australia’s broader share market failing to match global counterparts. There was also disappointment with a previous star in CSL whose price declined by -39%.

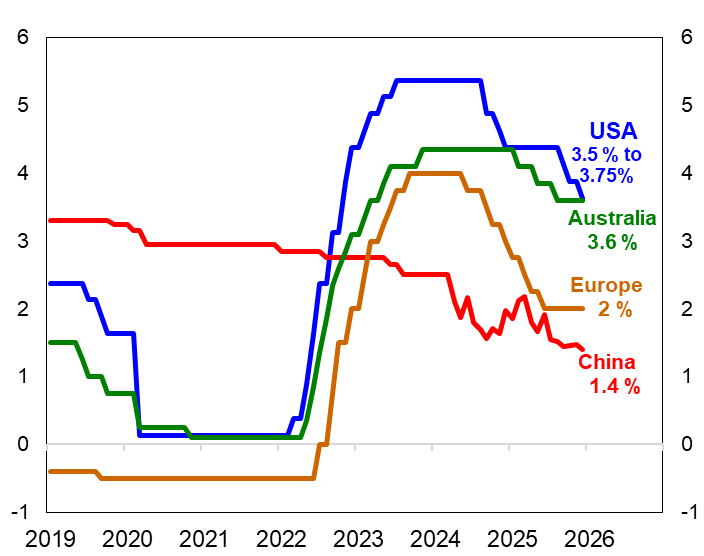

Australian bonds annual returns in 2025 were modest at 3.2%. Even with the support of the Reserve Bank of Australia (RBA) cutting the cash interest rate three times from 4.35% to 3.60%, the revival in Australia’s inflation in the final months of the year caused consternation. Bond markets began to contemplate that the RBA could be raising interest rates in 2026 to reduce inflation.

Global bonds (hedged) delivered a more reasonable 4.4% annual return. Bond markets have experienced turbulence in the past year given the shifting sands on economic activity, inflation and political risks. Yet the benefit of lower interest rate settings by the American and European central banks provided the beneficial tailwind. Global high yield bonds (hedged) made a very strong 8.1% annual return as investors considered that the elevated yields available are attractive for income despite very narrow credit spreads.

Global economy is mixed but proved resolute to President Trump’s tirades

Global economic activity has been ‘multi-speed’ in the past year. The US economy has been the key source of strength. American technology companies have ramped up business investment in a spectrum of assets including advanced computer chips and large data centres for information storage. Notably, the US economy recorded annual gross domestic product (GDP) economic growth of 2.3% in the year to September 2025 compared to potential growth estimates of around 1.8%. Consumer spending has been solid given the benefit of Wall Street’s gains as well as Congress making permanent the large income tax cuts from President Trump’s first term in the White House back in 2017. Most American consumers have even shrugged off the higher prices imposed by President Trump’s tariff increases but the impact is more severe for low-income families.

Yet there has been signs of weakness with US jobs growth softening and the unemployment rate rising to a four year high of 4.6 %. The US central bank cited that the “downside risks” to the US job market were a key reason for cutting interest rates in 2025.

European economic growth has gradually picked up speed to 1.6% for the past year. Yet Germany has continued to struggle with only 0.3% annual growth given weaker global demand for their conventional luxury cars compared to China’s vast array of cheaper electric vehicles.

China’s economic growth at 5.2% in the past year appears impressive but there is a harsher reality beneath the surface. China’s consumer spending remains subdued given the weakness in the residential property market. Falling property construction and apartment prices have undermined confidence in China’s long term growth prospects. China is also being challenged by President Trump’s tariff agenda which has the potential to damage China’s exports. China so far has managed to find other destinations for its exports.

Amongst Australia’s other major trading partners, economic growth has also been more encouraging. India’s economic growth at 8.3% is the strongest amongst major nations and illustrates India’s long-term potential.

Australia’s economy has experienced improved consumer spending, modest jobs growth and a stable unemployment rate around 4.3% in 2025. However, consumer inflation remains high and persistent. Australia enters 2026 with the possibility that the central bank may need to raise interest rates to cool inflation.

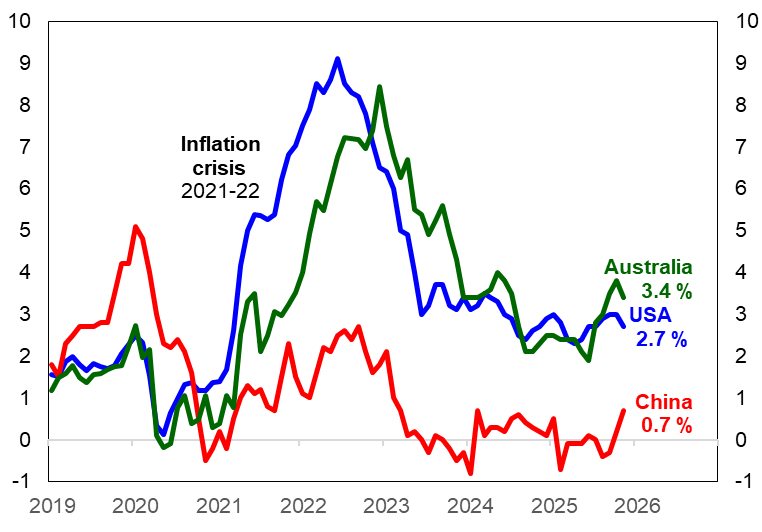

Inflation is still a concern to consumers

While global inflation has generated less headlines in the past year, prices are still a worry for the consumer. The “Cost of Living Crisis” that dominated 2021 and 2022 seems perpetual, as we are all still paying persistently high prices for the basics of food, health care and housing. Even the modern necessities of chocolate and coffee have become luxuries given the price surge over the past year.

Inflation in the United States has been stable around 3% for the year. Considering that President Trump’s tariffs are a tax that directly raise prices, the stable US inflation appears to have surprised. However, tariffs are a long-term challenge that ultimately raise consumer prices, distort economic activity and damage productivity. The full tariff pain for the US consumer is yet to come. Fortunately for the global economy, China continues to be a source of cheaper good prices as the ‘factory to the world’. However, China’s future role in producing low-cost goods is also questionable given President Trump’s agenda to contain China’s rise.