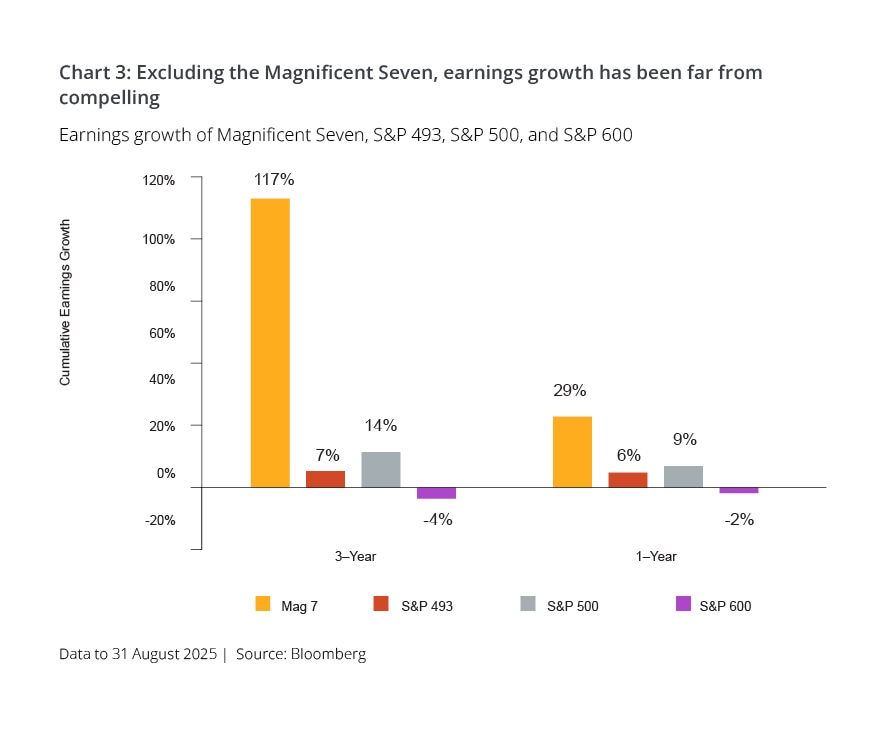

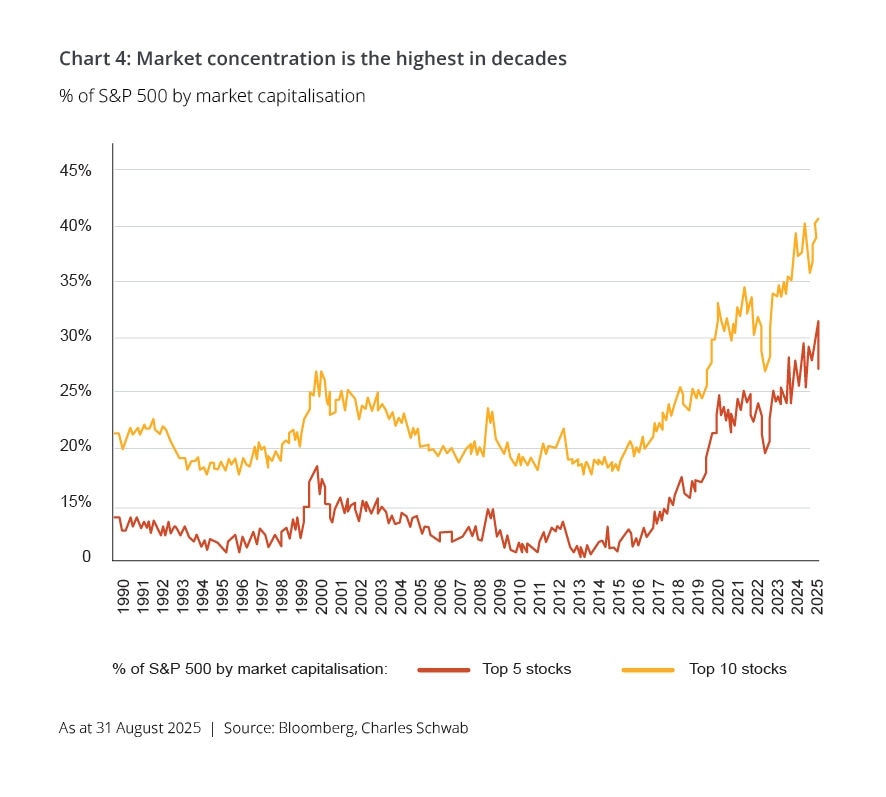

Non-US equities, including emerging markets, have been out of fashion for some time and it’s always difficult to pinpoint what may catalyse greater investor interest in markets beyond the United States.

In earlier decades — specifically the 1970s, 1980s, and 2000s — non-US equities, as represented by MSCI EAFE (Europe, Australasia, and the Far East), delivered stronger average annual earnings growth than the S&P 500.10 If new market drivers emerge, it’s not unreasonable to expect a changing of equity market leadership.

For now, active managers, like ourselves, can capitalise on this by identifying quality businesses with underappreciated earnings potential across global markets. Investors open to diverse risk profiles may find opportunities in a broadening of equity return drivers.

Emerging markets are worth a look

In our view, emerging markets present fertile ground for selective stock picking. China, which constitutes around 30% of the MSCI Emerging Markets Index,11 offers reasons for cautious optimism.

Despite the struggles of its real estate sector, China’s economy is diversifying, with growth in services, electric vehicles, AI, robotics, high-end manufacturing, and green energy creating compelling investment prospects.

Emerging markets also provide technology exposure at lower valuations than US tech leaders, with the technology sector comprising about 25% of the MSCI Emerging Markets Index.12 Asian technology, hardware, and IT firms are, we believe, well-positioned to benefit from consolidation and structural demand from hyperscalers.13

The healthcare sector in emerging markets is another area of innovation, with drug discovery rivalling Western companies in speed and quality.14

Additionally, demand for commodities such as palm oil, cocoa, copper, and precious metals should support exporting emerging markets and their companies.15

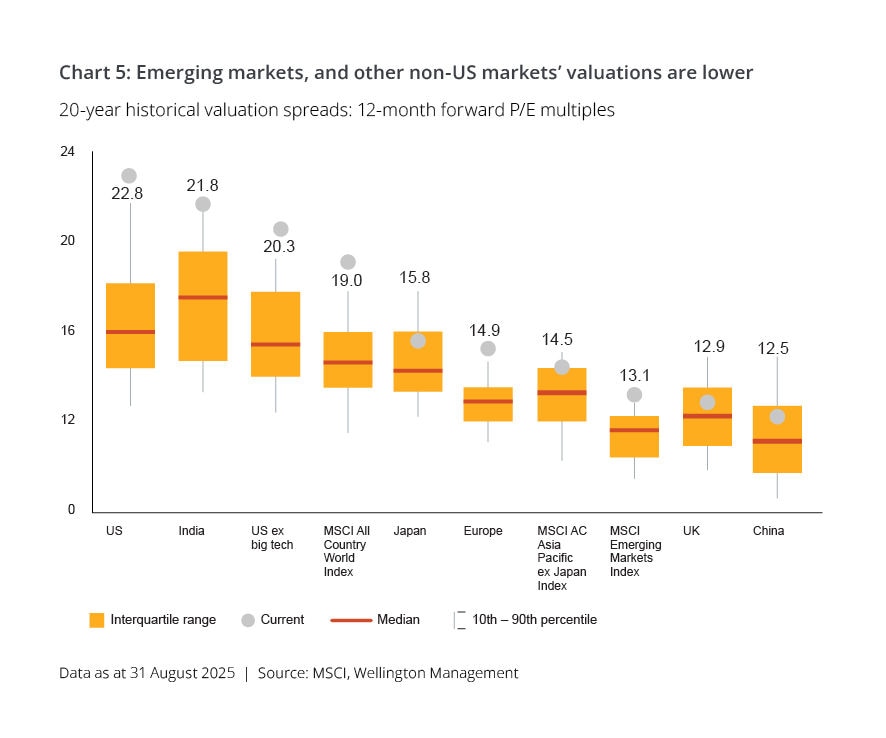

While emerging markets are more volatile than developed markets, their current valuation discount to developed market equities (Chart 5) suggests a reasonable risk-reward trade-off for investors willing to tolerate the associated risks.

Our asset allocation for these times

We maintain a modestly pro-risk stance, underpinned by supportive central bank policies, resilient corporate fundamentals, and improving economic growth signals. Given elevated US equity valuations, we are increasing allocations to non-US equity markets, with a particular focus on emerging markets.

Corporate balance sheets remain reassuring, with strong interest coverage, but tight public credit spreads temper our enthusiasm for this asset class. Private credit offers attractive risk-adjusted returns through disciplined mid-market lending. Nevertheless, we have a broadly neutral stance in private credit too as we think other unlisted asset classes offer better opportunities during this cycle.

Select real estate sectors, such as industrial properties tied to digitisation and logistics, remain important parts of our diversified holdings. We are also increasingly optimistic about domestic retail, particularly neighbourhood shopping centres, and opportunistic global real estate assets acquired at discounts with value-add potential.

In fixed income, we think a short duration position is sensible as long-end yields will likely trend higher as the global economy softly lands in 2025 and transitions back into expansion in 2026.

As disciplined, long-term investors, we adjust portfolios gradually, avoiding abrupt shifts.

Our active management approach is grounded in a strategic, long-term asset allocation framework, complemented by shorter-term economic and asset class return analyses. By incorporating multiple scenarios for market and economic outcomes, we avoid relying on a single forecast, enabling us to navigate a wide range of potential futures.