MLC Index Plus gives your clients access to returns from investment markets through an intelligent blend of index, enhanced index and active investment strategies formulated to keep costs down. The trusts are invested across a wide range of assets in and outside Australia.

-

MLC Index Plus Conservative MLC Index Plus Balanced

MLC Index Plus Growth

Objective Aims to:

- deliver returns that meet the trust’s benchmark, and

- reduce risk in the trust when we consider risks are too high.

Asset mix*

Total growth assets: 40-60%

Total defensive assets: 40-60%

Total growth assets: 60-80%

Total defensive assets: 20-40%

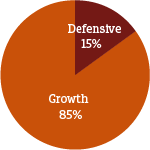

Total growth assets: 75-95%

Total defensive assets: 5-25%May suit investors who: - want some long-term capital growth and therefore seeks an investment that has similar weightings to growth and defensive assets;

- want to keep costs down by using mostly lower cost investment managers;

- understand that there can be moderate to large fluctuations in income and the value of your investment; and

- understand that the minimum suggested time frame to invest is at least five years.

- want long-term capital growth and therefore seeks an investment that has a strong bias to growth assets;

- want to keep costs down by using mostly lower cost investment managers;

- understand that there can be large fluctuations in income and the value of your investment; and

- understand that the minimum suggested time frame to invest is at least five years.

- want long-term capital growth and therefore seeks an investment that invests predominantly in growth assets;

- want to keep costs down by using mostly lower cost investment managers;

- understand that there can be large fluctuations in income and the value of your investment; and

- understand that the minimum suggested time frame to invest is at least seven years.

* Benchmark asset allocations as at 30 November 2023 for MLC Index Plus Conservative , MLC Index Plus Balanced and MLC Index Plus Growth.

-

Well-diversified

The MLC Index Plus trusts are well diversified both across asset classes and the investment managers we appoint. Our managers invest in thousands of companies and securities around the world across Australian and global shares, infrastructure, property securities and fixed income.

Index investing to keep costs down

Many of the trusts’ investments are in cost-effective index or enhanced index strategies. We use these approaches for shares and property securities.

Active investing where it matters most

We use active managers in asset classes where it can make an important difference to returns or risks without substantially increasing fees. In particular, we actively manage fixed income investments.

Expert management of the asset mix

Many low-cost investment funds take a ‘set and forget’ approach to asset allocation. In the MLC Index Plus trusts, our experienced investment team actively manages the asset allocation. Your clients benefit from the asset allocation insights of MLC’s expert Capital Markets Research team, which has managed MLC’s multi-manager diversified funds since 2005, for a much lower cost than in a fully active fund.

Choice of three trusts

Select the MLC Index Plus trust with the right asset allocation and investment timeframe to help your clients achieve their financial goals.

You can use the trust as your clients’ complete investment portfolio or as the core, adding other investments.Investing with MLC

MLC is one of Australia’s most experienced investment managers.For decades, our investment experts at MLC Asset Management have been designing portfolios using a multi-manager approach to help investors achieve their goals. MLC Asset Management’s investment team pioneered the multi-manager investment model in Australia over 35 years ago.

-

The portfolios are available through:

- Expand Essential

- Expand Extra

- MLC Investment Trust

- HUB24

-

Fund Lonsec Zenith MLC Index Plus Balanced Recommended* Recommended** MLC Index Plus Conservative Recommended* Recommended** MLC Index Plus Growth Recommended* Recommended** *The Lonsec Ratings (assigned as follows: MLC7387AU – April 2025; MLC7849AU – April 2025 and MLC9748AU – April 2025) are issued by Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421 445 (Lonsec Research). Ratings are general advice only and have been prepared without taking account of investors’ objectives, financial situation or needs. Consider your personal circumstances, read the product disclosure statement and seek independent financial advice before investing. The rating is not a recommendation to purchase, sell or hold any product. Past performance information is not indicative of future performance. Ratings are subject to change without notice and Lonsec Research assumes no obligation to update. Lonsec Research uses objective criteria and receives a fee from the Fund Manager. Visit lonsec.com.au for ratings information and to access the full report. © 2025 Lonsec. All rights reserved.

**The Zenith Investment Partners (“Zenith”) Australian Financial Services License No. 226872 ratings for MLC7387AU, MLC7849AU and MLC9748AU (all assigned in September 2025) referred to in this document are limited to “General Advice” (as defined by the Corporations Act 2001) for Wholesale clients only. This advice has been prepared without taking into account the objectives, financial situation or needs of any individual. It is not a specific recommendation to purchase, sell or hold the relevant product(s). Investors should seek independent financial advice before making an investment decision and should consider the appropriateness of this advice in light of their own objectives, financial situation and needs. Investors should obtain a copy of, and consider the PDS or offer document before making any decision and refer to the full Zenith Product Assessment available on the Zenith website. Zenith usually charges the product issuer, fund manager or a related party to conduct Product Assessments. Full details regarding Zenith’s methodology, ratings definitions and regulatory compliance are available on our Product Assessment’s and at http://www.zenithpartners.com.au/RegulatoryGuidelines